In today’s fast-paced healthcare environment, effective healthcare revenue cycle management (RCM) is essential for practices looking to enhance efficiency and profitability. As healthcare providers strive to navigate complex regulations and reimbursement structures, the demand for streamlined RCM services is on the rise. This blog will explore the benefits of RCM, its components, best practices, and how technology can transform your practice’s revenue processes.

How Revenue Cycle Management Benefits Healthcare Operations

At its core, revenue cycle management is a comprehensive process that oversees the financial flow of a healthcare practice from patient registration to final payment. Effective RCM leads to improved cash flow, reduced billing errors, and enhanced patient satisfaction. Here are some key benefits:

- Increased Revenue: By optimizing billing processes and ensuring timely claim submissions, practices can significantly increase their revenue.

- Improved Operational Efficiency: Streamlined RCM processes reduce administrative burdens, allowing healthcare providers to focus more on patient care rather than paperwork.

- Enhanced Patient Experience: A smooth billing process can lead to higher patient satisfaction. Patients appreciate clear communication regarding their financial responsibilities.

- Regulatory Compliance: With ever-changing regulations, effective RCM helps practices stay compliant, minimizing the risk of audits and penalties.

- Data-Driven Decisions: Analyzing RCM data can help practices identify trends and make informed decisions that support growth and operational efficiency.

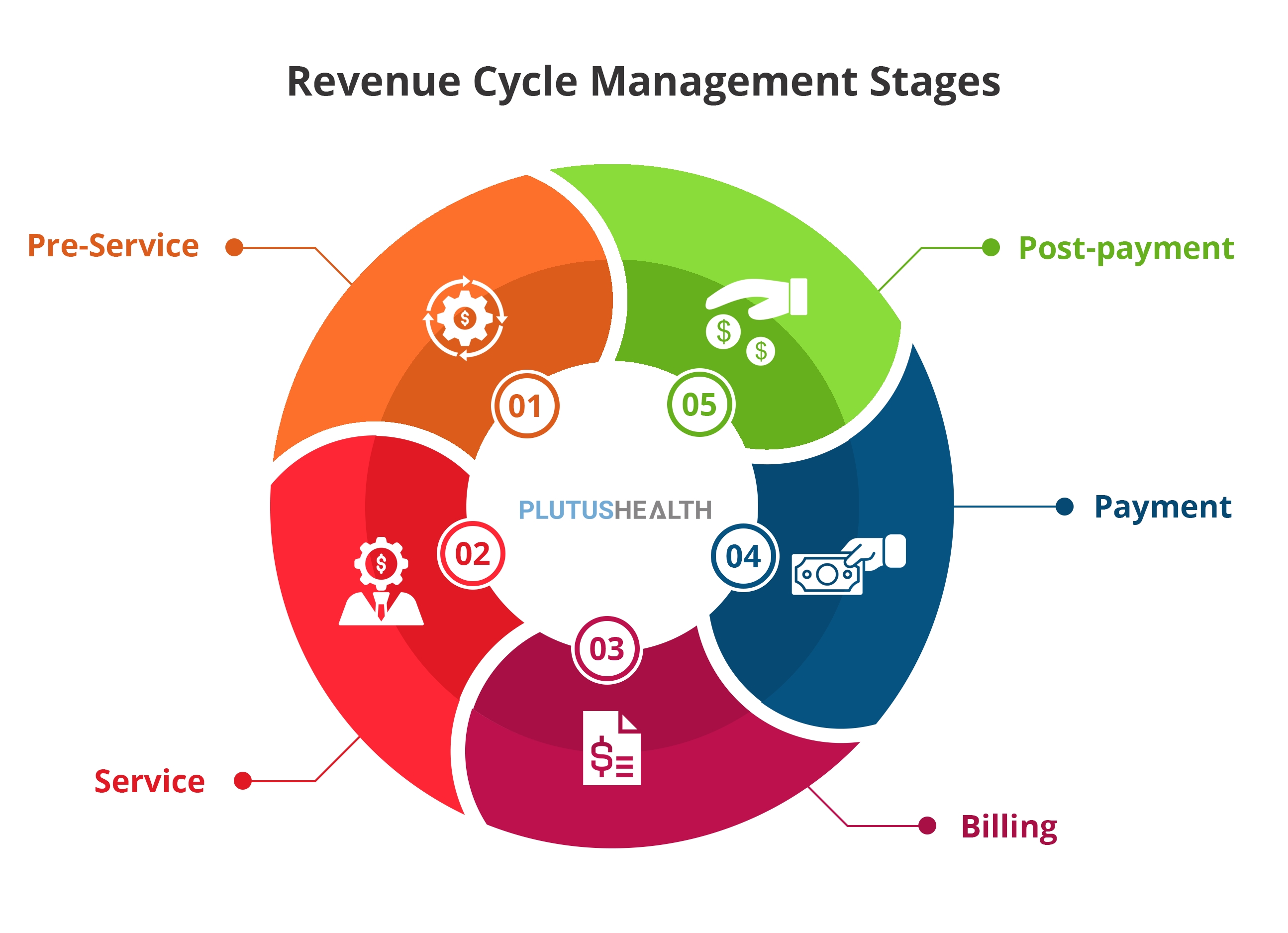

Components and Stages of the Healthcare Revenue Cycle

Understanding the components of the healthcare revenue cycle is crucial for effective management. The revenue cycle can be broken down into several key stages:

- Pre-Registration: Collecting patient information and insurance details before the visit to ensure accurate billing.

- Patient Registration: Gathering necessary documentation and verifying insurance coverage during the patient visit.

- Charge Capture: Documenting services provided to ensure all billable items are accurately recorded.

- Claim Submission: Sending insurance claims for reimbursement, which is critical to maintaining cash flow.

- Payment Posting: Recording payments received from both patients and insurers to keep financial records up to date.

- Accounts Receivable Management: Monitoring outstanding payments and following up on unpaid claims to reduce days in receivables.

- Denial Management: Analyzing and addressing denied claims to ensure maximum reimbursement.

- Reporting and Analytics: Reviewing performance metrics to identify areas for improvement and enhance overall RCM strategies.

Best Practices for Revenue Cycle Management

To maximize the benefits of RCM, consider implementing these best practices:

- Invest in Training: Ensure your staff is well-trained in billing and coding practices to minimize errors.

- Use Technology: Leverage RCM software to automate processes, reduce manual errors, and improve efficiency.

- Regularly Audit Claims: Conduct routine audits to identify trends in denials and make necessary adjustments to billing practices.

- Engage with Patients: Provide transparent billing information and support to help patients understand their financial obligations.

- Optimize Follow-Up Processes: Establish clear procedures for following up on unpaid claims and outstanding balances.

Submitting Insurance Claims: A Step-by-Step Guide

Submitting insurance claims can be a complex process. Here’s a straightforward guide to help your practice streamline this critical aspect of RCM:

- Gather Patient Information: Collect all relevant patient information, including insurance details, before the appointment.

- Document Services: Ensure accurate documentation of all services provided during the patient visit.

- Prepare the Claim: Complete the claim form accurately, including all required codes and information.

- Submit Electronically: Use an electronic claims submission system to submit the claim to the appropriate insurer.

- Monitor Submission: Track the status of submitted claims to ensure timely processing.

- Follow Up: If a claim is denied, investigate the reason for denial and take appropriate actions to appeal if necessary.

How the Revenue Cycle Management Process Affects Revenue

The revenue cycle management process directly impacts a healthcare practice’s financial health. Efficient RCM can significantly reduce the time between providing services and receiving payment. By addressing inefficiencies, such as claim denials or delays in payment posting, practices can improve their cash flow. A well-managed revenue cycle not only enhances profitability but also supports sustainable growth in an increasingly competitive healthcare landscape.

How Technology Can Help with Revenue Cycle Management

Incorporating technology into RCM can lead to substantial improvements in efficiency and accuracy. Here are some innovative tools and technologies that can enhance your revenue cycle:

- Automated Billing Systems: These systems help streamline billing processes, reducing manual errors and speeding up payment cycles.

- Analytics and Reporting Tools: Advanced analytics can provide insights into financial performance, helping practices make data-driven decisions.

- Patient Portals: Offering patients online access to their billing information can improve communication and encourage timely payments.

- Artificial Intelligence (AI): AI can analyze claim data to predict denials and suggest corrective actions, significantly reducing denial rates.

- Electronic Health Records (EHR): Integrating EHR systems with billing processes can ensure accurate charge capture and improve claim submissions.

Challenges in Healthcare Revenue Cycle Management

Despite the benefits of effective RCM, healthcare practices often face significant challenges:

- Complex Regulations: Navigating the myriad of billing codes and insurance policies can be daunting for many practices.

- High Denial Rates: Claims denials remain a significant issue, leading to revenue loss and additional administrative work.

- Staff Turnover: High turnover rates in billing and coding positions can lead to inconsistencies and errors.

- Patient Financial Responsibility: As patients take on more financial responsibility, practices must adapt their billing practices to accommodate this shift.

- Integration Issues: Ensuring seamless integration between different systems can be a challenge, leading to inefficiencies and errors.

Conclusion

Investing in robust healthcare revenue cycle management services is vital for practices looking to boost their efficiency and profitability. By understanding the components of RCM, implementing best practices, and leveraging technology, healthcare providers can optimize their revenue cycles and enhance patient experiences. As the healthcare landscape continues to evolve, staying ahead of trends and challenges in RCM will be crucial for sustained success. Embrace the future of healthcare by prioritizing effective revenue cycle management today!